New criteria for real estate investment funds

Compared to the previous law on investment funds the new act on collective capital investment brings the following amendments:

- Simplification of the regulation and its descriptive document

- Permitted investments

- Undeveloped land must be made available and must be ripe for development

- Distribution of risks and restrictions:

- Land subject to planning and building laws must account for only 20% of the real estate inventory

- Mortgage exposure must be maximum 50% of the current market value

- Also includes foreign real estate (prerequisite: ability to assess value)

- Shares in other real estate funds2 or stock exchange listed real estate companies (restriction: maximum 25%

of fund assets) - Derivative financial instruments (for hedging purposes only3) and where in accordance with investment policy)

- Issuing shares in real estate funds

- The number of new shares to be issued muts not be determined in advance / the planned share is sufficient

- Investments in kind

- On approval by the supervisory authority (Swiss Federal Banking Commission [EBK])

- Amendment of funds regulation required

- Valuation specialists

- Two natural persons or one legal entity

Extension of the numerus clausus to the possible forms of vehicle

The KAG regulates the remaining structures for the identified collective capital investments in the form of skeleton law. The KAG provides for the following as investment vessels / legal entities:

- Previous and new (contractual) investment funds

- Variable capital investment companies (SICAV)

- Fixed capital investment companies (SICAF)

- Limited partnerships for collective capital investments

Unfortunately, the Real Estate Investment Trust (REIT) is not included on the legislator’s list of capital investment vehicles.

Commercial Law Characteristics & Duty of Authorisation and Approval

Click to enlarge.

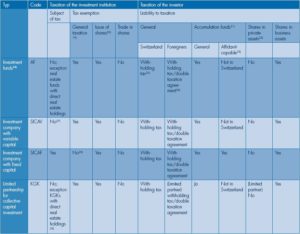

Taxation Characteristics

Click to enlarge.

2 Including REITs

3 To protect against market, currency and interest tisks.

4 Authorisation for “bearers”.

5 Approval for “product”.

6 At the annual general meeting and by inclusion on the supervisory board (3 to 7 members).

7 Principle of the unitary share (no share certificates, profit participation certificates or preferential shares); true no-par shares; Two types of shares are possible: company shares (always nominal shares) and investor shares; no subscription rights (except for real estate SICAV).

8 Suitability for real estate investments: not foreseeable at present.

9 AG = incorporated company.

10 Not listed on the Swiss stock exchange.

11 Form of vehicle for real estate investments similar to private equity (practiced in the legal form of the ordinary limited partnership (KommG) prior to the introduction of the KAG).

12 KGK = limited partnership for collective capital investment; arising in contrast to the limited partnership under the Swiss Code of Obligations (OR-KommG) with entry in the commercial register; partnership capable of holding legal rights.

13 OR-KommG = general limited partnership regulated by the Swiss Code of Obligations.

14 Qualified investors only.

15 The consequence of the voluntary resignation of a partner is dissolution.

16 100% real estate allocation possible.

17 Construction and real estate projects must be possible.

18 External asset managers subject to authorisation.

19 No direct taxation and no Swiss Federal Old Age and Survivors’ Insurance (AHV).

20 No issuing tax.

21 Restitution of shares in funds: the yield contained in the restitution price is subject to withholding tax (VST); Withholding tax is reclaimable.

22 There is reservation for taxation as a so-called “professional securities dealer”, provided that the prerequisites are given; in its communication the Federal Council of Switzerland puts on record that a private person who buys or sells shares in investment funds should not be considered to be a professional securities dealer on the basis of this fact alone.

23 Funds wherein at least 80% of the taxable profits from shares is expected to originate from foreign sources; the Swiss Federal Tax Administration (FTA) on request grants authorisation for withholding tax not to be paid on presentation of a bank certificate (affidavit) confirming that the profits were paid, transferred or credited to a foreigner.

24 Unfortunately at this point it is not possible to discuss the tax situation with regard to investment funds and the depositary bank, in particular whether and to what extent the services are subject to VAT.

25 Withholding tax/restitution of withholding tax.

26 Double taxation agreement.

27 SICAV are subject to the law but not to taxation (same treatment as contractual investment funds).

28 Taxation as a company under general commercial law (disadvantage: double taxation due to tax on profits for companies and tax on dividends for partners).

29 As far as the exception is concerned, the Swiss Federal Tax Administration (FTA) assumes that a KGK can be taxed in the same way as a real estate fund with direct real estate holdings if for example it pursues a construction project, although mere open funds may be real estate funds in accordance with KAG and are required to own at least ten pieces of real estate.